|

We Hope You've Had a Great Week!,

Please see below our latest thoughts and commentary on all things investment related.

Market Commentary - Are You All In?

"Invest for the long haul. Don’t get too greedy and don’t get too scared” - Shelby M.C. Davis

The key to investing success is simple in theory: buy low and sell high, however, sentiment tends to get the best of investors the majority of the time.

America is unique to the world in that 75% of the population owns a piece of the stock market. This fact creates an emotional response to large market moving swings, over a large chunk of the population, and creates self-fulfilling momentum.

The question becomes ... what mechanism can we use to add back a little logic to an emotionally charged marketplace? The answer lies within the question.

A Mechanism Is What You Need

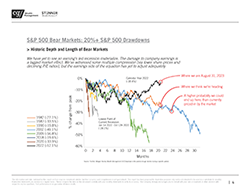

With investors currently holding record levels of cash, it can be tempting to fully deploy and ride the momentum to 'time a market'.

"In the financial markets, hindsight is forever 20/20, but foresight is legally blind. And thus, for most investors, market timing is a practical and emotional impossibility." -- Benjamin Graham

Within our wealth management practice, we prefer to purchase in tranches when we find attractive opportunities. None of us can be certain of what next week entails, so this method spreads out the risk we undertake rather than going all-in at once.

These tranches are purchased at predetermined price targets and/or dates, and reduce the risk and fear of investing at the wrong time.

Be A Robot, but Not An AI Robot

In 2022, the AI-led tech rally stopped a years-long market downtrend in its tracks ... and turned Nvidia into a household name. The rising tide lifted large-cap tech companies higher and CEOs were wise to use the word "AI" every chance they got.

Studies show the average investor jumps on the bandwagon and purchases a stock when it’s performing well (buy high) and when the price drops, that same investor often panics and unloads the position (sell low).

Interestingly, Vanguard claims their Advisor Alpha framework can add up to 3% net returns for clients, with the largest portion coming from behavioral coaching ( ie. not panic selling/buying). Its difficult to go against the trend, but the best investors are those that can tune out the noise, keep their emotions in check, and focus on the mechanics.

Wishing you and your families a lovely long weekend!

Tyus, and your Stenner Wealth Partners+ Team

| |

Our Weekly Market

Summary Highlights Here

"Bitcoin Back Above $50,000"

|

Read What We're Reading Here!!

"Variable Rate Mortgages

Making A Comeback"

|

|

|

| |

Listen to Erik Townsend:

Episode #414 feat. Louis Vincent Gave: Party Like it’s 1999

MacroVoices Erik Townsend & Patrick Ceresna welcome back Gavekal Founder, Louis-Vincent Gave. Erik & Louis discuss commodities, China, the Electric Vehicle Implosion, and why Louis says this feels like 1999 all over again.

|

Tyus Allen, CFA®

Associate, Financial Analysis

CG Wealth Management

2200-609 Granville St, Vancouver, BC V7Y 1H2

NA Toll Free: +1.833.783.6637 / T: +1.604.643.7765

E: tdallen@cgf.com / www.stennerwealthpartners.com

My LinkedIn / Stenner Wealth Partners+ on LinkedIn

BNN Bloomberg Podcast: SmartWealth with Thane Stenner

MEMBER OF THE CANADIAN INVESTOR PROTECTION FUND

|